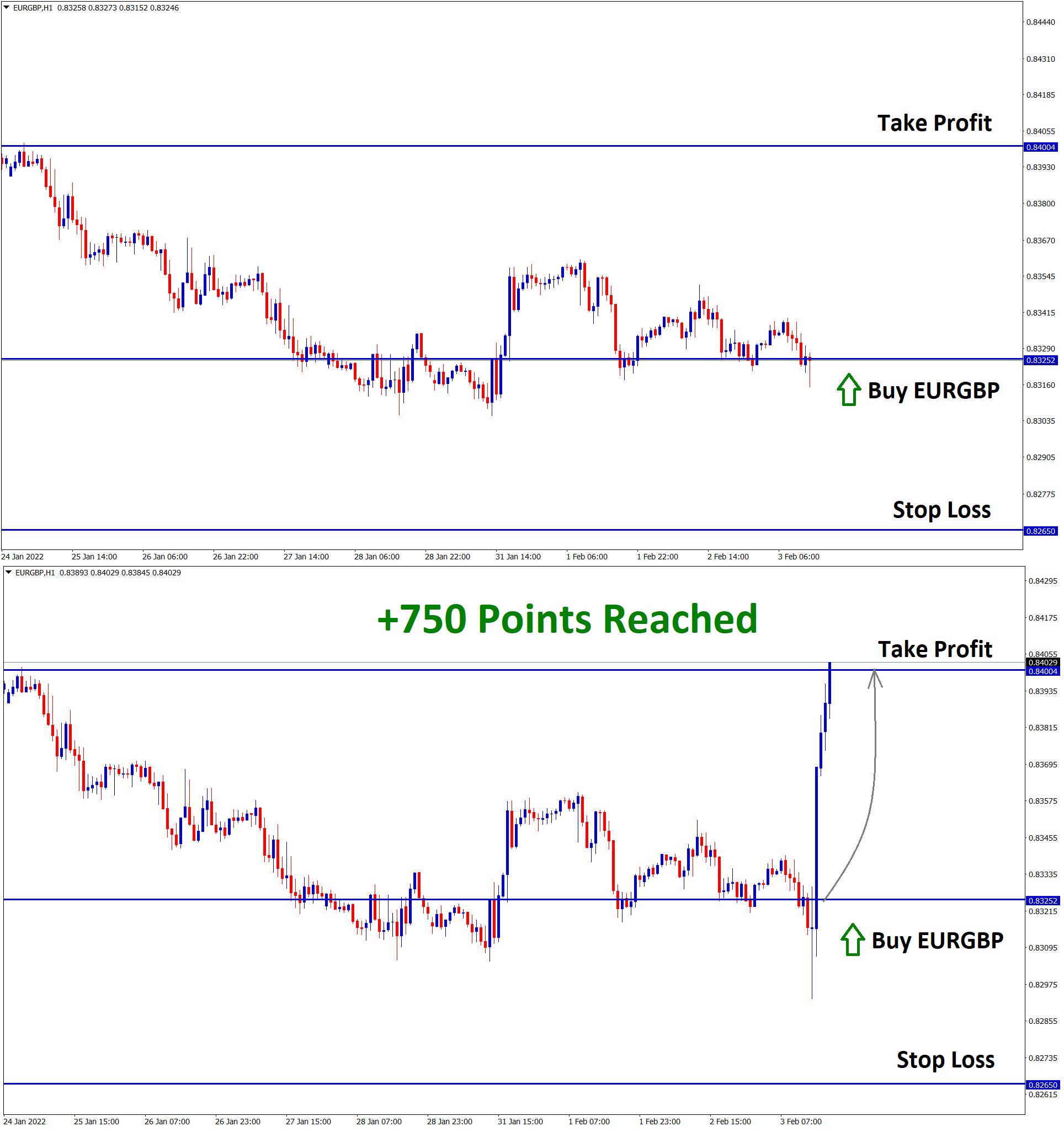

EURGBP Analysis

EURGBP hits the strong multi year support area in the Weekly Timeframe chart. Market is trying to rebound now from this support area for correction.

After the confirmation of upward movement, EURGBP buy signal given.

EURGBP reached the take profit target successfully

EURO: Euro CPI came higher than expected

Eurozone CPI rate printed at 5.1%YoY and Shows higher in the Decade.

And ECB might do 10Bps rate hikes in July 2022, as Analysts expected.

And Bank of England is going to rate hike today as MPC Vote 9:0 shows, and this is back-to-Back rate hikes in the last 2004 year.

Bank of England and ECB have more Divergence in Policy settings, more climate change between UK and EU makes more Covid-19 affected than the UK.

UK Pound: Bank of England Monetary policy forecast

Bank of England will hike a 25Bps rate today with a Vote of 9:0 Polls; this is the second time the Previous meeting hiked; the same stance happened in 2004.

The UK Inflation data printed at 5.4% Y/Y Versus 5.2% expected and inflation target of 6% will be achieved in April Month target.

And the unemployment rate in the UK is Falling to 4.1%, and rising concerns of Wage Price Spiral.

This Year Bank of England will do five more rate hikes, as Analysts expected.

Due to Omicron lower impact on the UK, Rate hikes are more considerations for controlling UK’s Inflation rate.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/