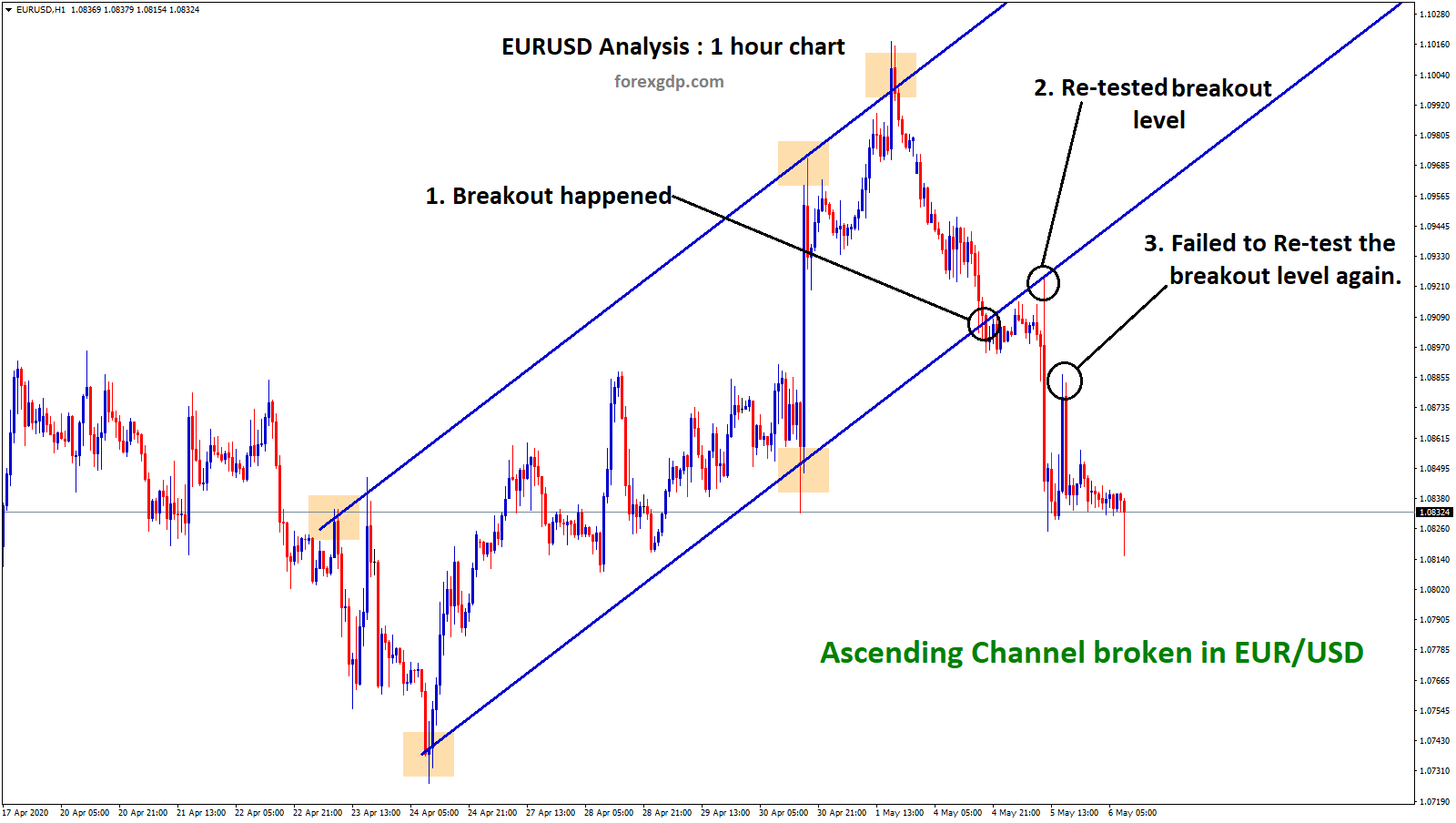

Ascending Channel Breakout in EURUSD hourly chart

Higher Highs, Higher Lows were printed on EURUSD 1 hour chart. Yesterday, EURUSD breakout the bottom zone of the Ascending Channel.

After breakout, we wait for the confirmation of re-testing.

But the re-testing of the breakout level in 2nd attempt fails. This shows that sellers are higher now than buyers.

We expect ranging move after breakout, market already made a range movement, it seems to fall down again by breaking the further bottoms.

US Economy is facing a lot of issues due to this Covid-19, but still Trump trying to balance the economy at this hard time. US-China fight started again.

ECB Committed to easy policy after German Court ruling

EURUSD Struggles to raise on this week as the German Constitutional Court warns that some of the major decisions taken by ECB (European Central Bank) isn’t backed by the European Union Treaty.

In Upcoming days, EURO have more chances to face bearish movement as the Governing Council retains a dovish forward guidance for monetary policy.

As per technical analysis, EURO USD is moving up and down between the specific price ranges. In smaller timeframes, it shows heavy bearish movement as Ascending Channel breakout in h1 chart, Sharp fall after the re-test bring only the sellers pressure.

EURO GDP could fall by 5 to 12% this year depending on the duration of Containment measures.

However, European Central Bank (ECB) remains committed in doing everything in its mandate to lift back its inflation to its target.

Today’s judgment by German Federal Consituational Court

The ECB takes note of today’s judgment by the German Federal Constitutional Court regarding the Public Sector Purchase Programme.

The bank said, adding that the European Court of Justice earlier ruled the programme legal.

“The Governing Council remains fully committed to doing everything necessary within its mandate to ensure that inflation rises to levels consistent with its medium-term aim.

The monetary policy action taken in pursuit of the objective of maintaining price stability is transmitted to all parts of the economy and to all jurisdictions of the euro area”

The ECB have 3 months time to prove that its asset-purchase program, which has bought 2.7 Trillion EUR (2.9 Trillion USD) of debt since from the year 2015 and it keeps increasing every month.

The EURO is facing a lot of challenges at this situation. So, EUR/USD have chances to fall down further by breaking the further support zones.

Check live Free forex signals now.

To increase your trading profits, read this below topics:

How to trade profitably using Chart Patterns?

Low risk, High reward trading strategies

How to get rich trading forex market?

Most predictable Currency Markets

If you want to learn more successful trading techniques with free mentorship support, you can purchase the forex trading video course.

Thank you.