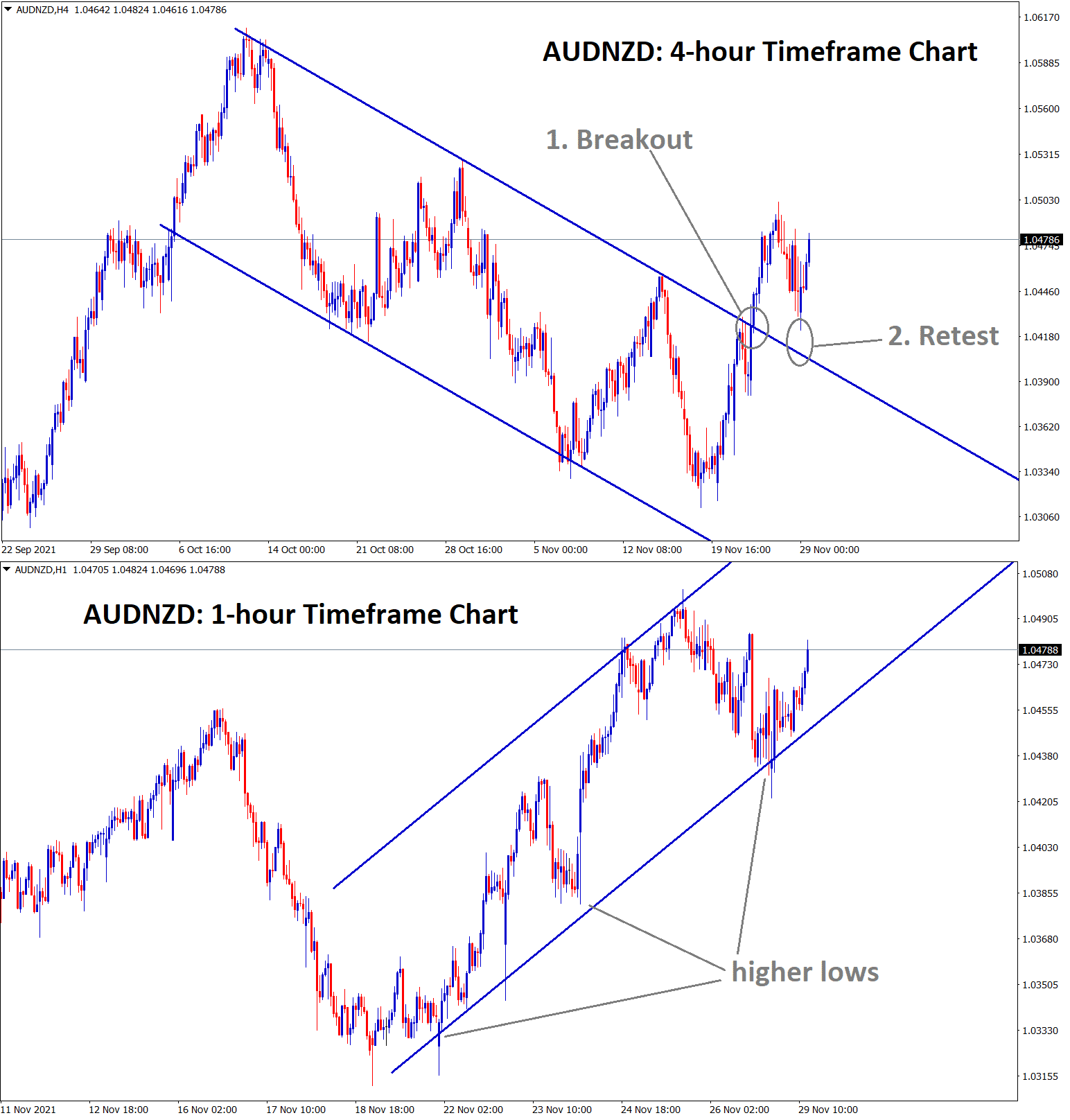

AUDNZD Analysis

AUDNZD has broken and retested the descending channel in the 4-hour timeframe chart. In the 1-hour timeframe chart, AUDNZD is moving in an Uptrend forming higher highs and higher lows.

After the confirmation of bounce back AUDNZD buy signal has given but it reached the Breakeven due to the consolidation and the 2 days protection time.

Australian Dollar: Iron ore Prices are hiked

The price of Iron ore reached $95 this week from a low of $82.50. And Miners of Iron ore preferred $20 per ton, but marginal players said $80-90 per ton for importers countries. Due to this, China is now seeing various other nations for Iron ore consumption.

But Australia is the largest exporter of Iron ore. And China seems a powerful nation to solve the problems of Iron ore prices hikes.

So, RBA maintains the cash rate at the same level without making any changes until 2024.

New Zealand Dollar: No rate hikes until February 2022 from RBNZ

New Zealand Dollar makes lower as Lower interest rates have to be sustained until next February month 2022.

And US FED taking fast actions against inflation rates make stable pricing for US Dollar and only due to the US Domestic data, New Zealand Dollar made movements this month.

Now China Economy recovery shows moderate progress and makes supports Kiwi exports.

And this week US Non-farm payrolls data is yet to be released; based on the numbers printed, New Zealand Dollar shows the Directions.

Are you trading all the time? or you just trading in your free time? please don’t do that. Trade the market only at the confirmed trade setups.

Get more confirmed trade setups here: https://signal.forexgdp.com/buy/