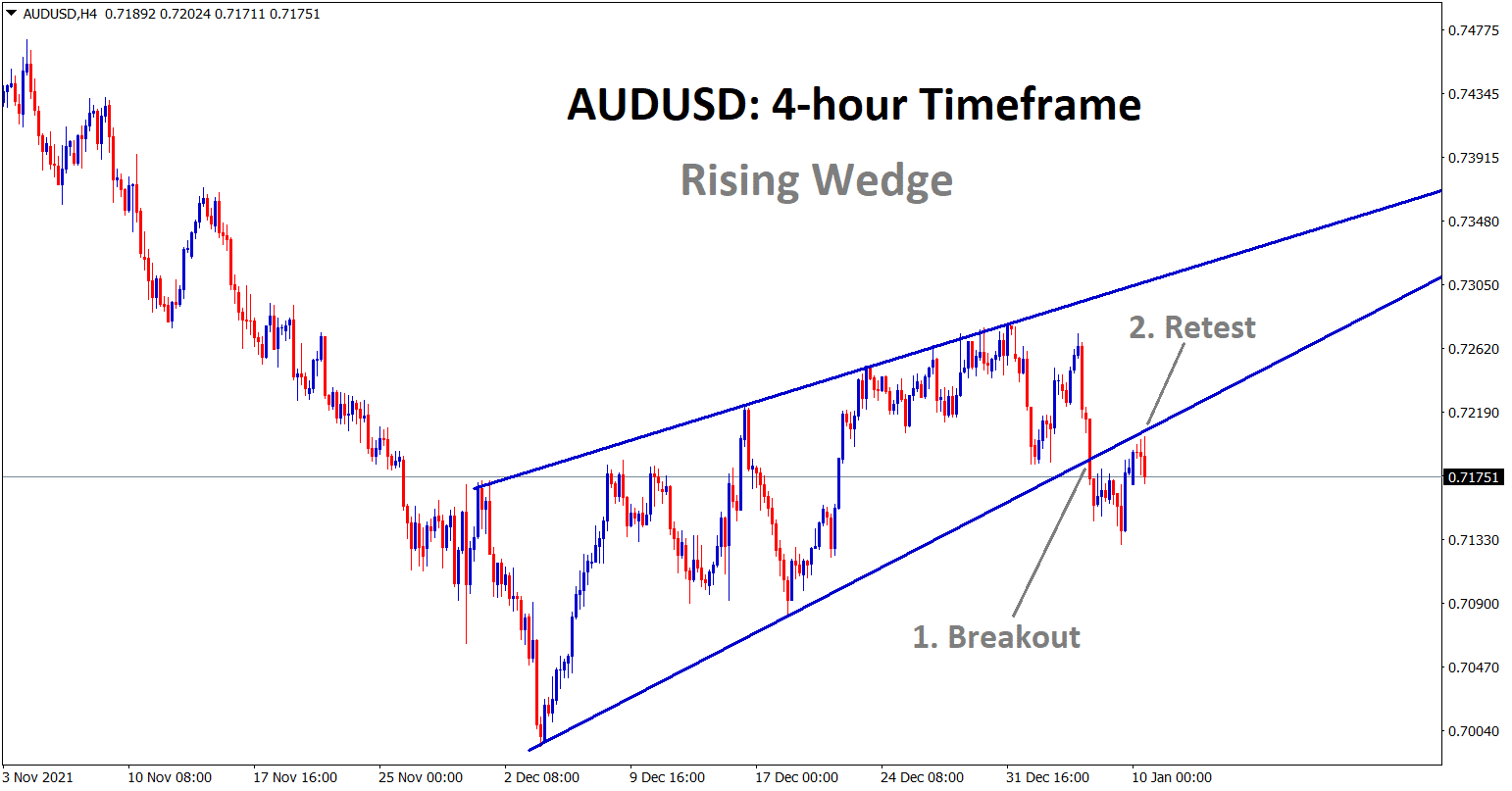

AUDUSD Analysis

AUDUSD has broken the bottom level of the Rising Wedge pattern. AUDUSD price has retested the broken level and started to fall.

After the confirmation of breakout and retest, AUDUSD sell signal is given, but market consolidates after the breakout and reached the SL price.

Australian Dollar: Australian Retail sales came up with higher

Australian Retail Sales data came at 7.3% versus 3.9% forecast and 4.9% previous one.

China CPI data is expected to drop from 2.3% to 1.8% today.

In China, Vegetables and Pork prices are falling; will impact the CPI data to lower.

But Chinese Yuan is getting stronger against US Dollar.

And China will report New Yuan Loan (Dec) expected to Drop at CNY1250 billion, slightly down from November’s CNY1270 Billion Figure.

Goldman Sachs cuts China’s Growth for 2022

Gold Man Sachs downgraded the China Growth to 4.3% from 4.8% where previous projected.

As Omicron variant increasing across China shows higher and Handling of Virus is more difficult for China this time, due to Real estate headache problem in another hand.

Already People Bank of China injected hefty funds as a liquid injection to markets; more easing monetary policy settings will create a Downward portion for China Economy growth.

Only the Curable stage will attain after the winter season; the second half of 2022 will see some relief from Covid-19.

Goldman Sachs maintained its view of 50-basis points cut in reserve requirement ratio in the First quarter.

US Dollar: FED Powell testimony makes confidence for Investors

USD sinks last night after FED Powell Testifies rocks the market for counter pairs.

FED Powell reiterated the exact words as explained in last month FED meeting.

That Fed will soon do rate hikes in March this year and never short the balance sheet immediately after rate hikes.

This news keeps calm for investors fear of mind on the last day.

Reducing the size of the Balance sheet won’t happen in quick mode; we have seen the US Economy recovery and make appropriate adjustments according to the situation that occurred.

Today US CPI data will publish, the main stem of US Domestic data this week; based on numbers, only FED will act soon to control inflation numbers.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/