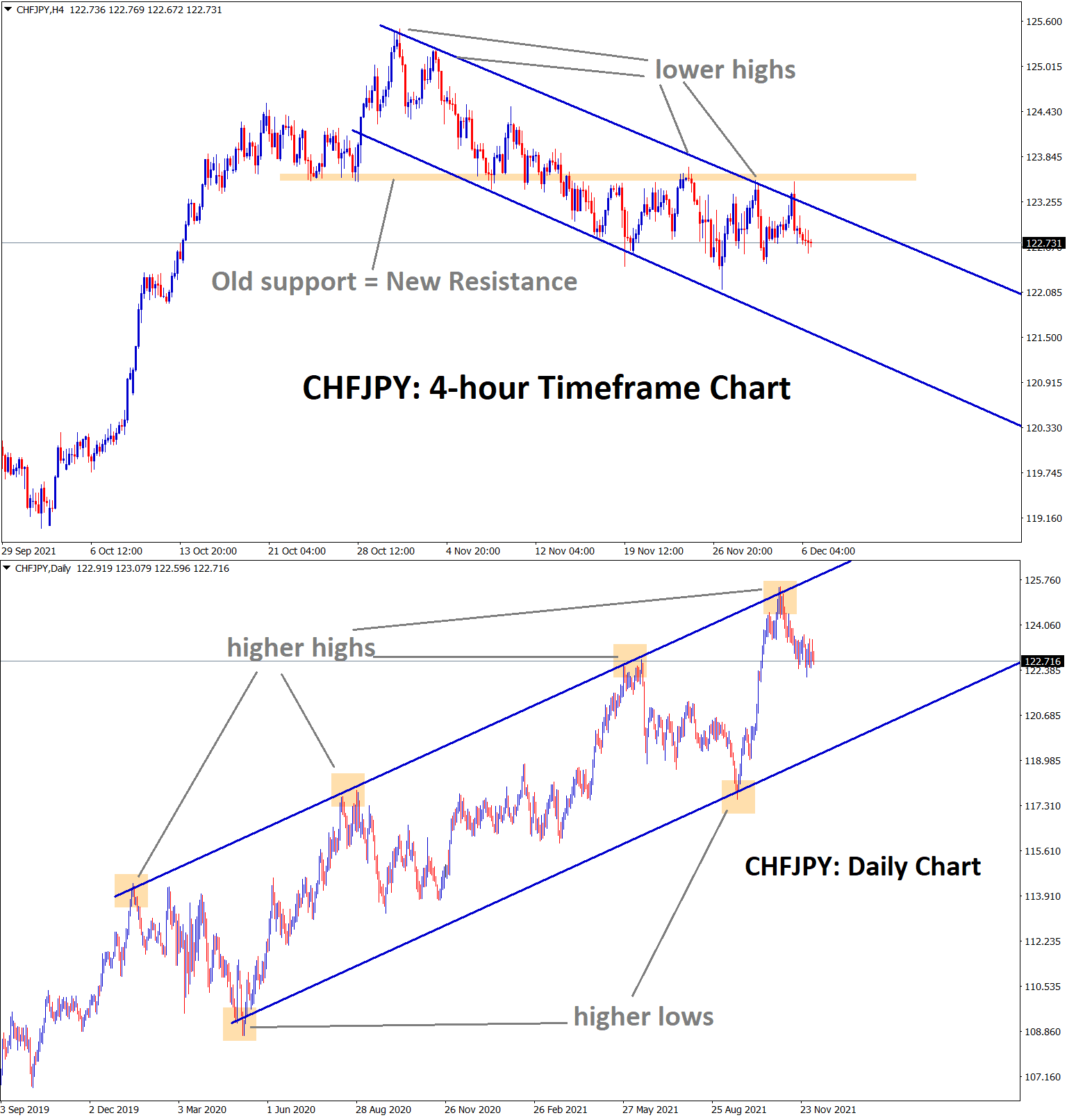

CHFJPY Analysis

CHFJPY is falling from the lower high of the descending channel and the horizontal resistance area in the 4-hour timeframe chart.

In the daily timeframe chart, CHFJPY is making a correction from the higher high area of the major ascending channel.

CHFJPY sell signal given after confirming the downward movement and it went near to the target, consolidates and closed at break even as per 2 days protection rule.

We always want you to trade safe under all the market conditions.

Swiss Franc: SNB Governing member Andrea Machler speech

SNB Governing Board member Andrea Machler said SNB anytime intervene in foreign exchange markets to stabilize the Swiss franc in regular momentum.

As the Swiss Franc sees higher against EURO to six years high, it is time to intervene to add foreign currencies and sell Francs to stabilize the Swiss franc.

SNB intervention in foreign currencies accumulation is only for Swiss Franc stabilization and not for trading purposes. We will not watch every time shock in currency markets.

And Our aim for inflation target is 0-2% for the next three years, and the Swiss Economic is on the way to recovery, We believe the 2% target soon we achieved in 3 years.

Japanese Yen: The US Has boycotted Olympics in Beijing

Japanese Yen has benefitted as tensions rise between the US and Russia, imposing economic measures if Russia takes on Ukraine.

And the US has boycotted the Winter Olympics in Beijing due to China alleged human Violations against Muslims in the Uyghur region.

Due to these issues, the Japanese Yen keeps higher ahead of US and Russia concerns, other side US and China on Human violations issue.

And Japanese Government announced a Trillions of Japanese-Yen stimulus to invest in economic recovery; hopes are available as soon as the Japanese economy takes recovery.

Bank of Japan member speech

Bank of Japan’s Masayoshi Amamiya said Japan’s economy is stagnating, and economic recovery will be seen next year-end.

And this comment after Japanese GDP Quarter-on Quarter basis fell by 0.90% worse than forecast of 0.80% Drop.

In the third quarter, the Japanese economy shrank 3.6%, worse than the 3.0% estimated. This is mainly due to the impact of Private spending, which is less due to the resurgence of Covid-19.

And the Wholesale inflation increased to 40-year highs, and the corporate goods price index gained 8.5% in November than 8.0% in October.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/