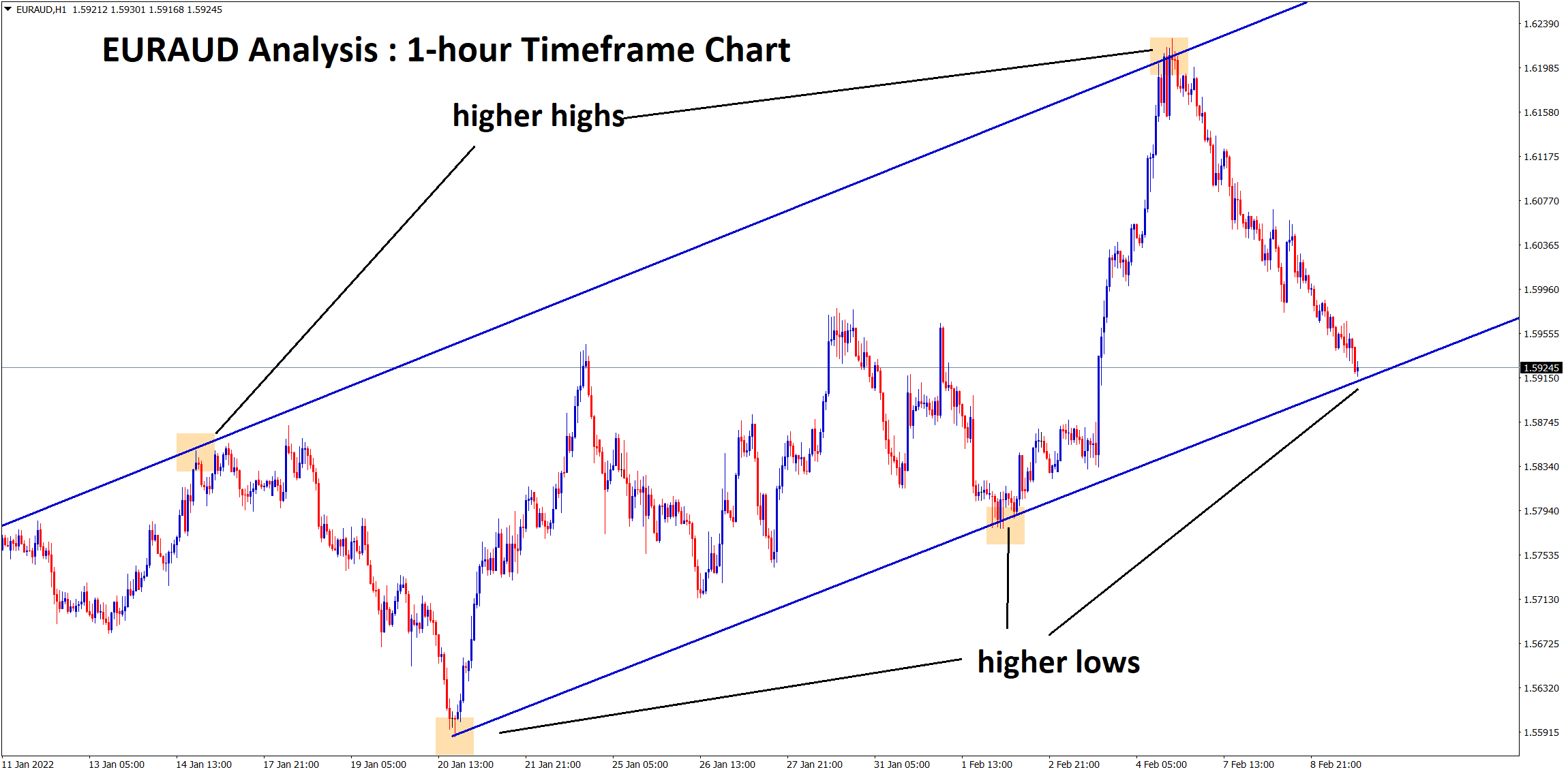

EURAUD Analysis :

EURAUD has reached the higher low area of the uptrend line in the 1-hour timeframe chart.

After the confirmation of upward movement EURAUD buy signal given.

But EURAUD hover around the entry price range and start to make a ranging movement between the entry price levels for a long time.

The market kept moving up and down between the entry price ranges.

As per signal following rules, This signal has made ranging movement within the protection time the EURAUD signal has closed at an entry price level. (Signal given at 11.30 pm AEDT, as per signal rule the trade protection should be carried out on next day 11.59 p.m AEDT)

For new users: Please note that: EURAUD signal has been closed at entry price level due to lack of movement and the 2 days protection rule. Keep following our signals as per the signal rules given to you under each signal message : https://signal.forexgdp.com/follow

If you know our signal rules, please take this signal quiz test here: https://signal.forexgdp.com/follow/#quiz

Please be patience and wait for the next good opportunity signal. We always want you to trade safely at all market conditions.

EURO: ECB Inflation forecast for 2022 and 2023

The quarterly release of the European Commission is set to release today.

Euro inflation like to ease in 2023 and GDP like to improve, and Growth Figures are cut in 2022 by 0.30% to 0.40%, while inflation numbers are 3.5% target for the current year.

And the Euro Area inflation for 2023 is below the 2% target, so quick rate hikes are expected in 2023.

And ECB Board member Isabel Schnabel said inflation remains higher than expected, and this ECB Hawkish tone does not change energy prices.

The Bundesbank President and ECB Board member ECB’s Nagel said the first step to end the Bond purchases and then raise rates is better for ECB.

Australian Dollar: RBA Governor Lowe Speech

John Edwards, a former member of the Reserve Bank of Australia, said RBA would do quick rate hikes four times during the Second Half of 2022.

And the RBA Governor Lowe said raising rates is a Good one, but RBA cannot do this until the Economy could take shape to a pre-pandemic level.

Today US CPI data set to publish and expected reading is 7.3% Y/Y which is the highest since 1982.

Australian Dollar set to higher and reach the next resistance zone of 0.72 if inflation rate ticked higher.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/