The Origin of FOREX exchanging follows its history to hundreds of years prior. Distinctive coinage and the need to trade them had existed subsequent to the Babylonians. They are credited with the first utilization of paper notes and receipts. Hypothesis barely ever happened, and positively the tremendous theoretical action in the business sector today would have been disapproved of.

Ancient Times

In those days, the estimation of products was communicated regarding different merchandise (likewise called as the Barter System). The undeniable impediments of such a framework empowered setting up all the more for the most part acknowledged mediums of trade. It was critical that a typical base of quality could be built up. In a few economies, things, for example, teeth, quills even stones filled this need, yet soon different metals, specifically gold and silver, built up themselves as an acknowledged method for instalment and additionally a dependable stockpiling of quality. The exchange was conveyed among individuals of Africa, Asia and so on through this framework.

Coins were at first stamped from the favoured metal and unstable political administrations, the presentation of a paper type of legislative I.O.U. amid the Middle Ages likewise picked up acknowledgement. This sort of I.O.U. was presented more effectively through power than through influence and is currently the premise of today’s cutting edge monetary standards.

World War I

Prior to the First World war, most Central banks bolstered their monetary standards with convertibility to gold. Notwithstanding, the gold trade standard had its shortcomings of blast bust examples. As an economy reinforced, it would import an incredible arrangement from out of the nation until it kept running down its gold stores required to bolster its cash; thus, the cash supply would reduce, financing costs heighten and monetary movement eased back to the point of retreat. At last, costs of things had wound up in a sorry situation, seeming appealing to different countries, who might sprint into purchasing fierceness that infused the economy with gold until it expanded its cash supply, drive down loan fees and restore riches into the economy..

Be that as it may, for this kind of gold trade, there was not as a matter of course a Centrals bank requirement for the full scope of the administration’s cash holds. This did not happen regularly, however when a gathering mentality cultivated this lamentable idea of changing over back to gold in mass, frenzy brought about alleged “Keep running on banks ” The mix of a more noteworthy supply of paper cash without the gold to cover prompted annihilating swelling and coming about political flimsiness. The Great Depression and the evacuation of the highest quality level in 1931 made a genuine respite in FOREX market action.

From 1931 until 1973, the FOREX business sector experienced a progression of changes. These progressions incredibly influenced the worldwide economies at the time and the hypothesis in the FOREX markets amid these circumstances was little.

Keeping in mind the end goal to ensure nearby national premiums, expanded outside trade controls were acquainted with keep business sector strengths from rebuffing money related flippancy.

World War II and the Bretton Woods Agreement

Close to the end of World War II, the Bretton Woods assertion was come to on the activity of the USA in July 1944. The meeting held in Bretton Woods, New Hampshire rejected John Maynard Keynes proposal for another world store coin for a framework based on the US Dollar. Global organizations, for example, the IMF, The World Bank and GATT were made in the same period as the rising victors of WWII looked for an approach to stay away from the destabilizing money related emergencies prompting the war. The Bretton Woods understanding brought about an arrangement of altered trade rates that reestablished The Gold Standard incompletely, settling the USD at $35.00 per ounce of Gold and settling the other principle monetary forms to the dollar, at first planned to be on a lasting premise.

The Bretton Woods framework went under expanding weight as national economies moved in diverse bearings amid the 1960’s. Various realignments held the framework alive for quite a while however inevitably Bretton Woods broke down in the mid 1970’s after president Nixon’s suspension of the gold convertibility in August 1971. The dollar was not any more suited as the sole worldwide cash during a period when it was under extreme weight from expanding US spending plan and exchange deficiencies.

Second Half of 20th and Early 21st Century

The most recent couple of decades have seen remote trade exchanging form into the world’s biggest worldwide business sector. Confinements on capital streams have been uprooted in many nations, leaving the business sector powers allowed to change remote trade rates as indicated by their apparent qualities.

The European Economic Community presented another arrangement of settled trade rates in 1979, the European Monetary System. The journey proceeded in Europe for coin solidness with the 1991 marking of The Maastricht arrangement. This was to settle trade rates as well as really supplant a hefty portion of them with the Euro in 2002. London was, and remains the key seaward market. In the 1980s, it turned into the key focus in the Eurodollar market when British banks started loaning dollars as a different option for pounds with a specific end goal to keep up their driving position in worldwide money.

In Asia, the absence of maintainability of settled remote trade rates has increased new significance with the occasions in South East Asia in the last some portion of 1997, where a great many currencies was debased against the US dollar, leaving other altered trade rates specifically in South America likewise looking exceptionally defenceless.

While business organizations have needed to confront a great deal more unpredictable cash environment as of late, speculators and monetary foundations have found another play area. The FOREX trade advertise at first worked under the national banks and the legislative establishments yet later on it obliged the different organizations, at present it likewise incorporates the website blasts and the internet. The span of the FOREX showcase now overshadows whatever other speculation market. The outside trade business sector is the biggest budgetary business sector on the planet. Roughly 1.9 trillion dollars are exchanged every day in the remote trade market. It is evaluated that more than USD 1,200 Billion are exchanged each day. It can be said effortlessly that FOREX business sector is a lucrative open door for the cutting edge wise financial specialist.

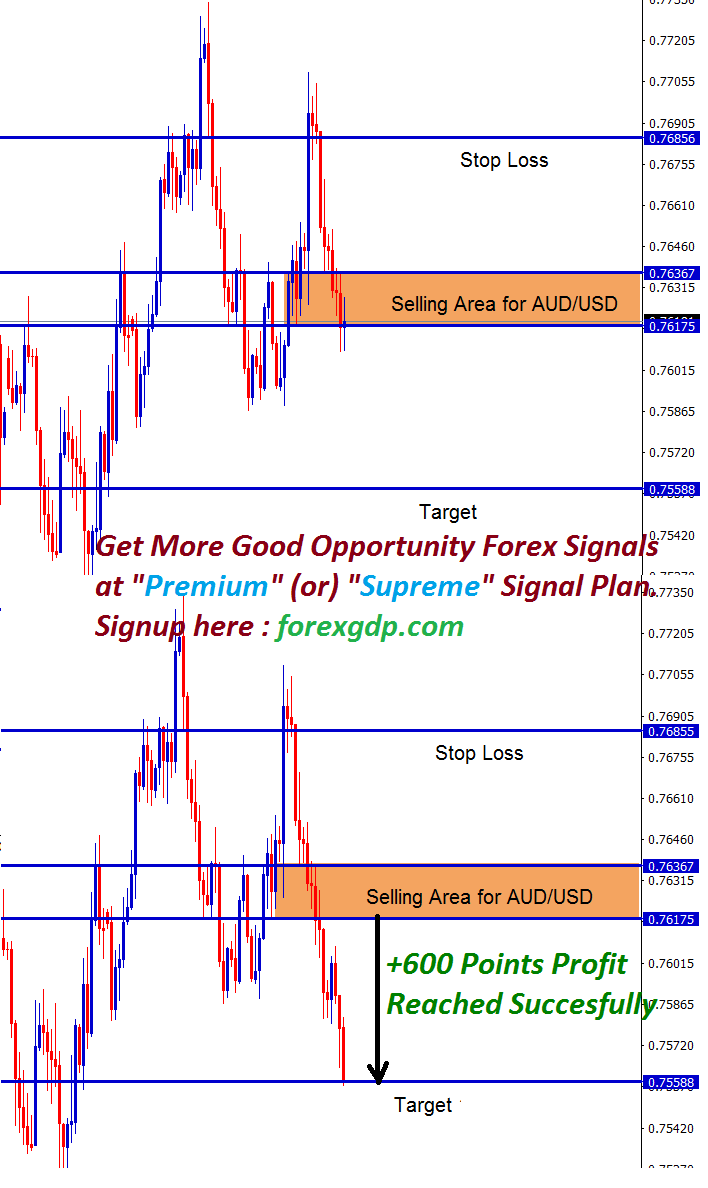

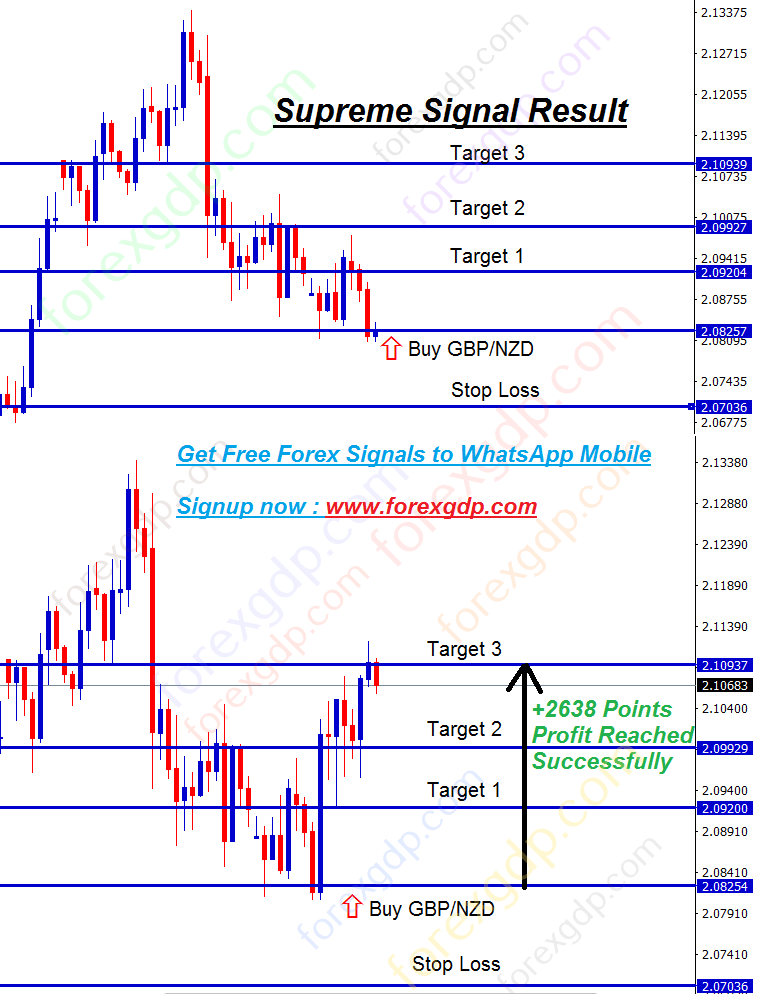

If you like to receive the best forex signals at a good trade setup, you can Try free forex signals. (or) if you need additional important trade signals with high accuracy, Join now in Supreme or Premium forex signals plan.

If you want to learn trading from 20+ years expert traders, Join forex trading course online now.